If you're an employer, it's essential to understand Form 941: Employer's Quarterly Federal Tax Return. Employers use this form to report wages and taxes paid to employees and withhold income and payroll tax for a specific quarter throughout the year. As such, understanding this definition can save your business time, money, and headaches in complying with federal taxes.

In this blog post, we'll break down what the Form 941 filing requirements entail so that you can meet filing deadlines and stay up-to-date on best practices when submitting these forms. Keep reading to get informed on everything related to "Form 941: Employer's Quarterly Federal Tax Return."

What is Form 941 - Employer's Quarterly Federal Tax Return

Form 941: Employer's Quarterly Federal Tax Return is a federal form employers use to report wages and taxes paid to employees and withhold income and payroll tax for the preceding quarter.

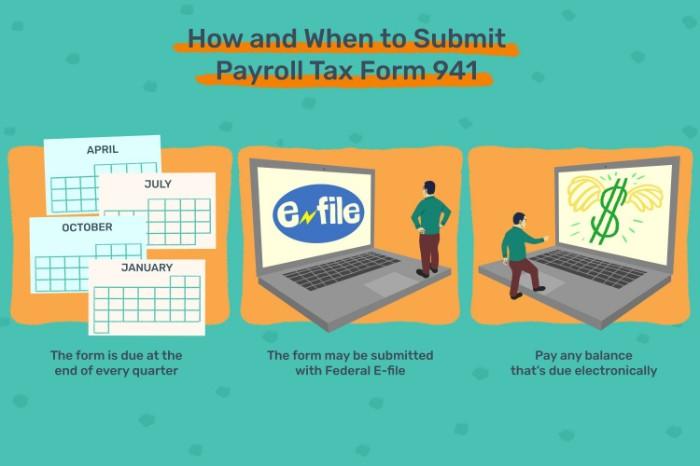

Form 941 must be submitted on or before the end of each quarter for employers to remain compliant with federal tax laws. When submitting Form 941, employers must include detailed information.

Employers should also ensure that Form 941 is properly filled out before submission to avoid penalties or fines. Form 941 filing requirements are essential for all businesses to understand to meet federal tax deadlines and remain compliant with current regulations.

By taking the time to understand Form 941 and following filing instructions, employers can rest assured that they are fulfilling their federal tax obligations. As such, Form 941 can help businesses save time, money, and stress in complying with federal taxes.

What Information To Include In The Form And Any Relevant Deadlines or Late Penalties

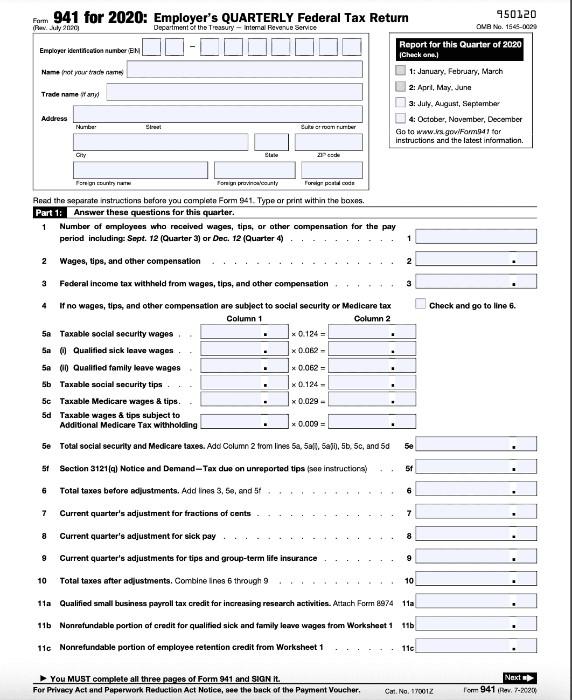

Form 941: Employer's Quarterly Federal Tax Return includes employer details (including name, address, and identification number), information about wages and salaries paid to employees every quarter, and taxes withheld from employees for payroll tax, social security, and medicare tax.

It also requires employers to include the total taxes due over the quarter. It is important to note that Form 941 needs to be filed before the end of the month after the end of the tax quarter, and employers must submit Form 941 by either mailing or filing electronically with the Internal Revenue Service (IRS).

Failing to file Form 941 on time can result in penalties from the IRS, so it's important to stay up-to-date on filing deadlines and best practices. Form 941: Employer's Quarterly Federal Tax Return is essential for employers to understand and comply with to remain compliant with federal taxes.

Step-by-step instructions for filling out Form 941

Form 941 is the quarterly tax form employers must submit to pay federal income and employee payroll taxes. This form can seem daunting, but following certain steps will be much easier.

Here are some step-by-step instructions for filling out Form 941:

- Gather all of your records that list employee payments during the calendar quarter in which Form 941 needs to be filed. These include wages, salaries, bonuses, tips, and other compensation paid during the filing period.

- Enter employee earnings on Form 941 in Parts 3 and 5 using information from W-2s or other records of payment activities during this time frame.

- Calculate the total Form 941 liability by adding the total wages and taxes paid during the filing period in Part 4.

- Sign Form 941 and submit it to the IRS with your payment.

Following these steps, you can complete Form 941 and avoid any potential issues or penalties associated with late or inaccurate filings.

Supporting Documents Needed to File Form 941 - W-2 forms and wage reports

Form 941 requires employers to report wages and taxes paid to employees every quarter. To file Form 941 accurately, employers must provide supporting documentation, including W-2 forms and wage reports for each employee.

These documents provide essential information about the employee’s gross wages, taxable wages, Medicare wages, Social Security tips, and other important details. Employers must ensure their records are up-to-date and accurate to properly complete Form 941.

It's also important to note that Form 941 is separate from reporting taxes related to Form W-2, so you must keep accurate records of both forms when filing your quarterly tax returns. If employers fail to submit Form 941 on time or with inaccurate information, they may be subject to hefty penalties and fees.

By understanding Form 941 and taking the necessary steps to provide accurate supporting documentation, employers can ensure that their quarterly taxes are filed correctly.

By understanding Form 941 and its filing requirements, employers can stay on top of their quarterly tax filings and avoid costly errors or penalties.

Consequences for Not Filing Form 941 on Time - Penalties, fines, and interest

Regarding Form 941 filing requirements, employers must take special care in meeting deadlines and submitting accurate information. Failure to comply with Form 941 filing regulations can lead to significant penalties, fines, and interest charges from the IRS.

Employers who fail to pay their taxes on time could be charged a 5% penalty per month up to 25%, depending on how long the return has gone unfiled. Additionally, failure to deposit Form 941 taxes owed will result in 2% of the unpaid tax for each month or part of a month that the deposit is late.

Employers may also be subject to interest charges on any late payments made to the IRS. Employers must comply with Form 941 filing requirements to avoid expensive penalties and interest charges. To minimize the chances of Form 941 filing errors, employers should thoroughly review their Form 941 information and submit it promptly.

FAQs

When is Form 941 due?

Form 941 is due on the last day of the month after the end of each quarter. For instance, if your company’s tax period ends June 30th, Form 941 would be due July 31st. It is important to note that Form 941 must be filed electronically with the IRS.

Where can I get more help with Form 941?

If you need additional assistance with Form 941, it is recommended to contact a tax professional for guidance. Additionally, the IRS website contains helpful information about Form 941, including instructions on how to fill out and file the form correctly.

How often is Form 941 filed?

Form 941 must be filed quarterly, meaning employers should submit Form 941 four times a year to the IRS. Form 941 covers wages and taxes paid during each specific quarter of the calendar year. It is important to note that Form 941 must be filed electronically.

Conclusion

Form 941 is important for employers to be aware of and submit at the end of each quarter. It reports employee wages and federal income taxes withheld from their paychecks. Knowing when this form is due, what documents are needed, and how to properly complete it can prevent unnecessary fines, penalties, or interest for late filing. If you need additional guidance on filing Form 941: Employer’s Quarterly Federal Tax Return Definition, contact the professionals here today!